Introduction

Home Electrification and Appliance Rebates have been touted as a provision of the Inflation Reduction Act (IRA) that will deliver benefits to low- and moderate-income (LMI) households. The program allocates about $4.3 billion to the states to provide up to $14,000 in point-of-sale rebates to eligible households. Eligible purchases include certain appliance upgrades (including electric heat pumps, heat pump water heaters, induction stoves, and heat pump clothes dryers), as well as electrical wiring, panel upgrades, insulation, air sealing, and ventilation. The Home Electrification and Appliance Rebates program is one of two rebate programs included in the IRA, the other being the “HOMES” or “whole house” rebate program. As HOMES does not require prioritization or preferences for LMI households, it is not considered here.

In a previous analysis of the IRA conducted by Just Solutions, we concluded that, although the electrification rebates program is restricted to LMI households, it would be unlikely to benefit low-income households. These households are more likely to be renters who will be reliant upon landlords to access many of the benefits that the program provides.

In addition to the uncertain access to program benefits for renters, the eligibility criteria for the electrification rebates program, which is based upon Area Median Income (AMI) calculations, may present additional barriers for low-income households:

- The manner in which AMI is calculated means that a larger percentage of residents will be eligible for the rebates in lower-income counties located in higher-income urban areas. Depending upon the way in which states choose to distribute benefits (assuming the states accept the federal funds to begin with), the use of AMI could pose significant access challenges for low-income households. For example, if funds are distributed at the county level on the basis of total population size rather than the size of the eligible population, fewer benefits will be directed to lower-income communities with smaller population size. At the same time, more people will be eligible for the limited resources in such counties in areas that have a high regional AMI, thereby putting lower-income residents at a further disadvantage.

- In higher-income communities, the 150% eligibility threshold authorized in the IRA will expand eligibility beyond what is frequently considered a moderate or “middle” AMI income threshold. In areas with a high degree of income inequality, lower-income households, which face significant systemic barriers to accessing assistance, will be less likely to receive the benefits for which they are eligible in the absence of additional set-asides or other preferences.

The program guidance recently released by the U.S. Department of Energy (DOE) includes some provisions that advance equity.1 Minimum set-asides are included for low-income households and for multi-family buildings where 50% or more of residents are low-income. In both cases, states have discretion to prioritize low-income households at even higher rates.

Electrification Rebates Program Eligibility and Area Median Income

Area Median Income is calculated each year by the U.S. Department of Housing and Urban Development (HUD) and is commonly used as a threshold for determining eligibility for various assistance programs.

As established by Congress, eligibility for the rebate program is based on a household’s income relative to the AMI. Those individuals and households with incomes under 80% of AMI can receive a rebate at the point of sale for 100% of the cost of eligible purchases. Those with incomes between 80% and 150% of AMI can receive 50% rebates.

In characterizing AMI levels, various federal programs typically refer to income levels under 50% AMI as “ very low” or “low income,” those under 80% AMI as “low” or “moderate income,” and up to 120% as “middle” income.2 The electrification rebates program, therefore, extends the definition of “moderate income” beyond what is often used in programs targeting benefits to lower-income households.

How AMI is Calculated

HUD bases its annual AMI calculations on median family income data from the Census Bureau, which is typically higher than median household income. This is because “families” consist of at least two related household members, and “households” include not only families but also individual unrelated people living together or those living alone, such as elderly people or students, who often have lower incomes. The 2023 AMI calculations are based on 2021 Census Bureau data. They then include an adjustment for inflation, based on the Consumer Price Index.

Geographic areas for determining median income can be:

- A Non-Metropolitan County, which is an individual county outside of a metropolitan area.3

- A Metropolitan Statistical Area (MSA), including one or more counties. MSAs usually include an urban core, surrounded by neighboring areas that have strong economic or social ties to the core area. MSA boundaries are defined by the U.S. Office of Management and Budget.

- A HUD Metropolitan Fair Market Rent Area that includes one or more counties. These are subdivisions of MSAs and are defined by HUD.4

Why AMI Matters

AMI is a good measure to use when the goal is expanding eligibility for programs or benefits. Since it is based on median family income, which is typically higher than median household income, income eligibility thresholds are set to a higher level, thereby making more people eligible. It also includes an inflation adjuster.

Linking eligibility to AMI can present equity challenges, however, given the barriers low-income communities often face in accessing benefits. Especially when resources are limited, as is the case with the electrification rebates program, expanded eligibility criteria can result in reduced access for low-income households. Eligible households face barriers that include:

- Inequities in awareness of or information about the programs or benefits that are available.

- Language access.

- Transportation.

- Onerous application processes and other administrative burdens.

Without robust and targeted outreach and additional set-asides, low-income residents could be more likely to face difficulty in accessing limited resources when the county in which they reside:

- Has a high degree of income inequality, as measured by the Gini coefficient.

- Is part of a MSA or HUD Metro Fair Market Rent Area that includes more populated counties with higher median family incomes.

Gini coefficients are measured from 0, representing perfect income equality, to 1, which is perfect income inequality. Gini coefficients of less than .4 are considered to be more equal. Scores of .4 and .5 are considered high levels of inequality, and above .5 is considered severe income inequality.

Across the country, many LMI communities are located in areas with higher rates of income inequality. Looking at the 322 U.S. counties where 40% or more of family households had median incomes at or below 200% of the 2020 Federal Poverty Line, only 7 (2%) counties had 2020 Gini coefficients lower than .4. Among the same populations, 239 (74%) communities had Gini scores between .4 and .5, and 76 (24%) communities had scores of .5 or higher. In comparison, 318 (11%) of the 2,820 remaining counties with higher-income populations had Gini scores below .4. In those areas with higher levels of inequality and where more households are eligible, low-income households could experience greater challenges in accessing benefits, depending on how funds are distributed.5

A Closer Look: Examples from Georgia and Texas

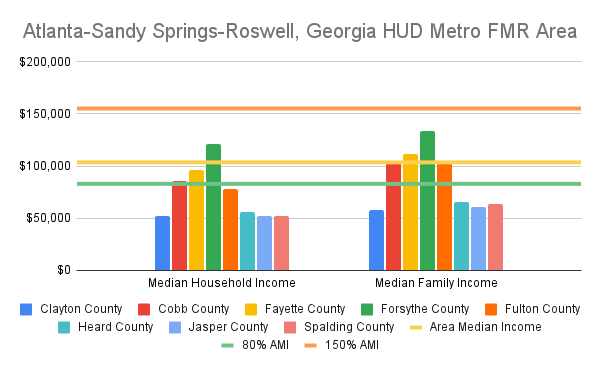

The Atlanta-Sandy Springs-Roswell, Georgia HUD Metro Fair Market Rent (FMR) Area is an enormous area comprising 24 counties, about three-quarters of which include census tracts that meet the criteria for being defined as a “disadvantaged community” in the Climate and Economic Justice Screening Tool. The area includes some of the wealthiest counties in the state and several counties that have significantly lower median income levels and higher poverty rates. The Area Median Income is $103,500, meaning that 80% AMI is $82,800 and 150% AMI is $155,250.

To get a sense of the variations between counties, four of the wealthiest counties in the HUD Metro FMR Area are compared to four of the lowest-income counties below.

Clayton County, Heard County, Jasper County, and Spalding County have the lowest median household income levels in the HUD Metro FMR Area. They had 2021 poverty rates ranging from 16.2% in Jasper County to 20.4% in Heard County. With a population of nearly 300,000, Clayton County is the largest of these counties. The other counties have relatively small, majority white populations. All of the counties had 2020 Gini coefficients of approximately .41, with the exception of Spalding County, which had a high degree of income inequality with a Gini coefficient of .5390.

In contrast, Forsyth County, Fayette County, Fulton County, and Cobb County have some of the highest income levels in the area. Forsyth County and Cobb County are the largest, with populations ranging from about 750,000 to over 1 million residents. With the exception of Fulton County where the poverty rate is about 13%, poverty rates in these counties are significantly lower, ranging from 5.3% to 8.6%. Gini coefficients ranged from .3985 in Forsyth County to .5395 in Fulton County.

What this means for residents is that, because the AMI is so high and eligibility thresholds set by Congress for the electrification rebates program goes up to 150% AMI, a very large percentage of residents could be eligible for the rebates in the lowest-income counties in the HUD Metro FMR Area. The lower-income communities might be areas where outreach efforts and expanded set-asides would bring particular benefit, especially if 100% set-asides at the <80% AMI level are adopted. However, these are also areas where distribution of funds at the county level would be most problematic. If funds were to be distributed by the state to the counties in the HUD Metro FMR Area, lower-income residents would be less likely to access benefits, given the size of the eligible population compared to the amount of resources available. Additionally, in counties with a high degree of income inequality like Fulton County, upper-income residents would be more likely to access benefits, given the 150% AMI cap and systemic barriers for low-income households.

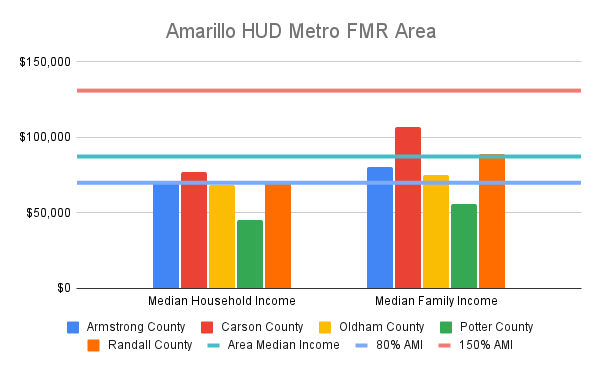

A second example is the Amarillo HUD Metro FMR Area in Texas. The Metro FMR Area includes five counties: Armstrong County, Carson County, Oldham County, Potter County, and Randall County. Potter County, which is home to Amarillo, had a 2021 population of about 119,000. It also had a fairly high 2020 Gini coefficient of .4817 and a 2021 poverty rate of 21.5%. The 2021 median household income was $45,096, while the median family income was $56,030.

The AMI in the Amarillo HUD Metro FMR Area is $87,300, approaching twice Potter County’s median household income. That means that the eligibility threshold for rebates covering 100% of the costs of qualified electrification projects is set at $69,840 (80% AMI). The allowable 50% rebate eligibility limit is $130,950, more than 2.5 times the median household income.

The county driving the AMI calculations is Randall County. In contrast to Potter County, the other counties in the area are all majority white. Armstrong, Carson, and Oldham Counties, however, are very small in population. Randall County is slightly more populous than Potter County and has much higher income levels, although it, like Potter County, has census tracts that meet the criteria for being defined as a “disadvantaged community.”6 Randall County had a median household income of $70,544 and a median family income of $88,738. Randall County also had a fairly high Gini coefficient of .4403.

Potter County’s, low-income population faces clear challenges in this Metro FMR Area. A very large proportion of residents will be eligible for the rebate program. Without targeted outreach and expanded set-asides at the <80% AMI level, Potter County households will be less likely to fully benefit from the program.

Conclusion

The electrification rebates program guidance recently issued by DOE includes provisions that can advance equity, but the degree to which the rebates reach low-income households now depends on the states. States can maximize benefit to low-income and disadvantaged communities by considering the degree to which AMI eligibility thresholds might affect access and utilization. If states allow for the allocation of funds up to the 150% AMI threshold, it is unlikely that low-income communities will benefit, apart from the required minimum set-asides. Opportunities exist to create broad benefit to the lowest-income communities, particularly in urban areas with a high AMI, by targeting outreach efforts and limiting eligibility to <80% AMI.

In implementing the electrification rebates program, State Energy Offices could ensure maximum benefits for low-income households by:

- Allocating 100% of rebates households with incomes of <80% AMI, multi-family buildings with at least 50% low-income residents, and disadvantaged communities.

- Leveraging categorical eligibility and self-attestation provisions to reduce barriers to participation.

- Distributing funds at the state level with robust outreach particularly directed to those low-income counties with a high AMI or, alternatively, distributing funds at the county level on the basis of the size of the eligible population rather than the total population.

Such action would also better advance the Justice40 Initiative, given that other aspects of the IRA, such as substantial tax credits, are not counted towards Justice40 calculations.7

- Our analysis of the DOE guidance can be found here. ↩︎

- National 2023 Area Median Income calculations by HUD include “very low” and “low” income limits of 50% and 80% AMI respectively. Elsewhere, such as in the case of the Community Reinvestment Act (CRA), 50% AMI is described as “low income” while up to 80% AMI is characterized as “moderate income.” The CRA then defines income levels up to 120% AMI as “middle income.” Similarly, the Neighborhood Stabilization Program, which has been governed by HUD, has used the term “middle income” to describe income levels up to 120% AMI. Other HUD programs define LMI households as having incomes below 80% AMI.

↩︎ - This analysis focuses particularly on the implications of AMI calculations for electrification rebates program eligibility determination for Metropolitan Statistical Areas and HUD Metropolitan Fair Market Rent Areas. In Non-Metropolitan Counties, AMI determinations more closely reflect household income levels in the particular county, since there is only one county involved. Eligible residents living in Non-Metropolitan Counties may face other challenges in accessing program benefits, however, including the lack of local administrative agencies and transportation, language, and technological barriers. ↩︎

- FY 2023 Income Limits Documentation System. ↩︎

- This analysis relies upon data from the 2021 American Community Survey, Table B17026, Ratio of Income to Poverty Level of Families in the Past 12 Months (5-Year Estimates). ↩︎

- Potter County and Randall County are the only counties in the Metro FMR Area with census tracts meeting the definition of a “disadvantaged community” in the Climate and Economic Justice Screening Tool. ↩︎

- Washington Post, “One year in, climate law tests Biden’s environmental justice pledge,” August 16, 2023. ↩︎