Climate justice is inextricably linked with economic justice, and individual and household economic precarity is increasingly important in the context of the climate crisis. As in so many other aspects of climate change, the household finances of low-income and communities of color are already experiencing impacts “first and worst.” Last fall, the U.S. Department of Treasury released a report describing ways that climate hazards could affect household finances, identifying where households are concentrated, and how to prepare for and adapt to climate hazards and improve household financial resilience. However, as my colleague, Dr. Cristina Muñoz De La Torre, wrote, the report stopped short of recommending solutions that address inequitable climate burdens.

SaverLife, a financial health nonprofit advocacy and membership organization, conducted a related research initiative, based on information reported by their members, to bring to light how climate change is affecting the financial health of low- to moderate-income households nationwide. This research has shown that LMI households are “unable to absorb the shocks and disruption of severe weather events without experiencing financial harm.” Moreover, while SaverLife members are interested in pursuing resilience and disaster preparation strategies, ranging from installing home batteries for backup power to weatherizing homes, they consider these investments largely out of reach.

These reports are just two examples of the growing body of research that shows how for low-income households and communities of color, climate hazards and economic hardship go hand and hand.

Climate-related events such as floods and hurricanes cause particularly harmful disruptions to the finances of these households. The loss of income, increased unexpected expenses, and missed monthly payments can lead to cascading effects that can set households further back and limit their ability to invest in resilience strategies. Because these households often start off lacking the financial resilience to prepare for and withstand climate hazards, when disasters and other climate-related hazards occur, these households may be caught in a vicious cycle that is extremely difficult to escape.

“Challenges accessing funds” is one of the three financial vulnerabilities highlighted by the Treasury report. Households may experience severe financial strain in the case of even brief interruptions in income or unexpected increases in expenses. This is especially true if they are unable to turn to savings accounts, credit, or insurance. Access to banking is also critical for receiving financial assistance to assist with recovery.

In California, the CalAccount Community Coalition, led by the California Public Banking Alliance, SEIU California, and Rise Economy, successfully advocated for the passage of AB 1177 (Santiago 2021). This law created the CalAccount Blue Ribbon Commission, chaired by State Treasurer Fiona Ma, to study the proposed CalAccount program, a free and accessible public option for basic financial transactions. Specifically, the Commission was tasked with overseeing a market analysis to determine whether it would be feasible for the state to implement CalAccount, “a voluntary, zero-fee, zero-penalty, federally insured transaction account, and related payment services.”

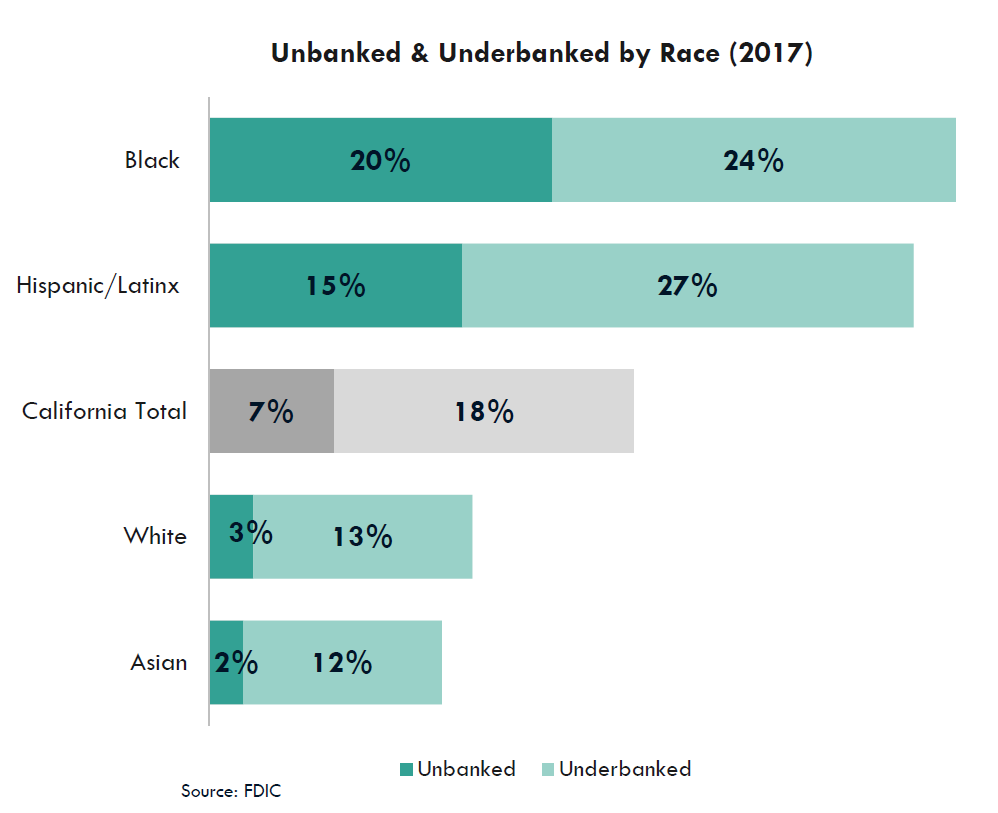

The scale of the problem of financial exclusion in California is significant, with approximately 1 in 5 households either unbanked or underbanked, and notable disparities across indicators including race and ethnicity and immigration status. According to an analysis of FDIC data by HR&A Advisors, Black and Latine households in California are much more likely to be unbanked or underbanked than white and Asian households, and there are an estimated 2.9 million unbanked or underbanked non-citizen immigrants in the state.

In addition to barring fees and penalties, key features of the CalAccount program include:

- Accessibility for individuals who may not have government-issued photo identification and individuals who do not have permanent housing;

- Enabling and streamlining remittance of local, state, and federal benefit and public assistance payments;

- Enabling payroll direct deposit;

- Establishing a process and terms and conditions for registered payees; and

- Requiring landlords to allow a tenant to pay rent and security deposits by electronic funds from CalAccount.

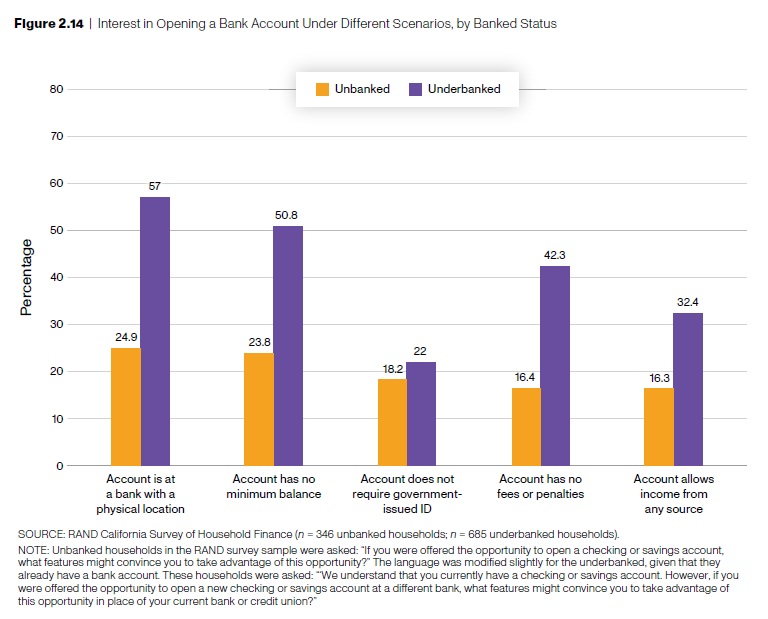

These features were chosen because they address the major obstacles that vulnerable households face in opening and maintaining bank accounts. Throughout the Commission process, workers and advocates provided testimony about the frustrations of unpredictable bank fees, penalties for not meeting minimum balance requirements, as well as the cost of alternative financial services like check cashing. These costs are a significant burden for low-income households and erode their financial resilience, leaving them poorly positioned to withstand climate hazards, as well as other emergencies. As a free public option for Californians to access their money, CalAccount would significantly improve the financial resilience of vulnerable households in the context of climate (and other) hazards.

Climate events may exacerbate existing challenges to accessing funds. For example, loss of power and internet may leave households that rely on online or mobile banking without access to funds. Households that rely on in-person banking services — which are more likely to be older, low-income, or have lower levels of educational attainment1 — may be similarly impacted if bank branches close due to physical damage of their building or road debris prevents entrance after a climate event. While CalAccount is primarily conceived as an online/mobile-first program, the RAND study evaluated scenarios where the program included access to existing ATM and bank or credit union branches as well as “additional state-designated locations.”

Federal financial regulators, including the Federal Reserve Board, Office of the Comptroller of the Currency, and FDIC have issued guidance to financial institutions encouraging them to temporarily waive fees and penalties on accounts and for ATM access in the post-disaster context.2 This shows that regulators recognize the critical importance of fee-free access to accounts in the climate disaster recovery context.

By providing better access to financial services, CalAccount would not only improve the household finances of the households that are most vulnerable to climate hazards, saving Californian households an estimated $3.3 billion in fees and interest,3 but would also provide the needed financial infrastructure to access and receive disaster recovery assistance. Through program design that is specifically tailored to reach the most vulnerable populations, CalAccount directly addresses the root cause of one of the key financial vulnerabilities that affect households.

It is important to note that while this discussion focuses on financial resilience in the context of acute climate hazards, such as hurricanes and wildfires, chronic and worsening climate hazards, like repetitive flooding and gradual heat increases — not to mention the emerging energy affordability crisis — are also significant drivers of household financial challenges. CalAccount’s registered payees feature helps address this by limiting late payment fees and penalties that registered payees (like utilities) can impose, reducing the risk of wrongful fee or penalty assessment.

Ultimately, the study conducted by RAND concluded that the CalAccount program is feasible, finding that societal benefits were likely to outweigh the costs of the program over a decade, as long as enrollment is adequate. Next, the Commission will make certain legislatively-required determinations about whether CalAccount can be implemented and whether revenues are likely to be sufficient to pay for program costs within six years of implementation, and deliver the study to the Senate Committee on Banking and Financial Institutions and the Assembly Committee on Banking and Finance. The CalAccount Community Coalition plans to work with the Legislature to introduce legislation to implement CalAccount in the 2025-2026 legislative session.

- Federal Deposit Insurance Corporation (FDIC), 2021 FDIC National Survey of Unbanked and Underbanked

Households (October 2022), https://www.fdic.gov/analysis/household-survey/2021report.pdf at 26. ↩︎ - U.S. Department of the Treasury, The Impact of Climate Change on American Household Finances (September 2023), https://home.treasury.gov/system/files/136/Climate_Change_Household_Finances.pdf at 27. ↩︎

- HR&A Advisors, The Cost of Financial Exclusion: Understanding the impact of the unbanked in California (May 2021), https://www.calaccount.com/s/CostOfFinancialExclusion_May2021.pdf at 15. ↩︎